quantpylib.datapoller

quantpylib.datapoller is a quant module used for multi-asset, multi-source/vendor/exchange financial data retrieval.

The datapollers are categorized into their data-classes, with current support for:

- crypto

- currencies

- equities

- exchange

- metadata

The datasources supported are:

- binance

- eodhd

- oanda

- phemex

- hyperliquid (whyperliquid)

- yfinance

In general, a trader may have requirements for different asset-class/categories of financial data, subscriptions to multiple data sources, with each data source supporting a subset of the asset-class universe. Each data source has its own endpoints, parameters, rate-restrictions and authentication flow - the datapoller abstracts these concerns to provide a seamless interface for data retrieval while attempting to maximize throughput.

Each datapoller is derived from the base quantpylib.datapoller.base.BasePoller class and implements a set of methods,

and routs the requests to the specified data source and endpoints. The supported data sources are written as wrappers

on the quantpylib.wrappers module, and their supported endpoints share the same function name

as in the datapollers.

The different datapollers are accessible via the master data polling class, given in quantpylib.datapoller.master.Datapoller object instance.

For instance, if we would like to get trade bars using the quantpylib.datapoller.currencies.Currencies.get_trade_bars,

we can do so by creating a obj = DataPoller(...) instance, and calling obj.currencies.get_trade_bars(...,src="oanda").

The function call is only valid if it is supported by both the datapoller and the datasource, which we can check by their matching

function signatures. In general each datasource has its own parameters to the vendor-specific endpoint, as well as different

specifications (such as start time of OHLCV historical request in YYYY-MM-DD vs unix-timestamp), so the library

provides a unified standard that convert between these specifications. In additional, the datapoller take in flexible arguments

to support the different configurations for each external API - it would alot easier to understand through the given examples.

Note that each of the datasource wrappers are also designed to be available for use as standalone Python-SDKs. Supported datapollers and datasources are added and updated frequently.

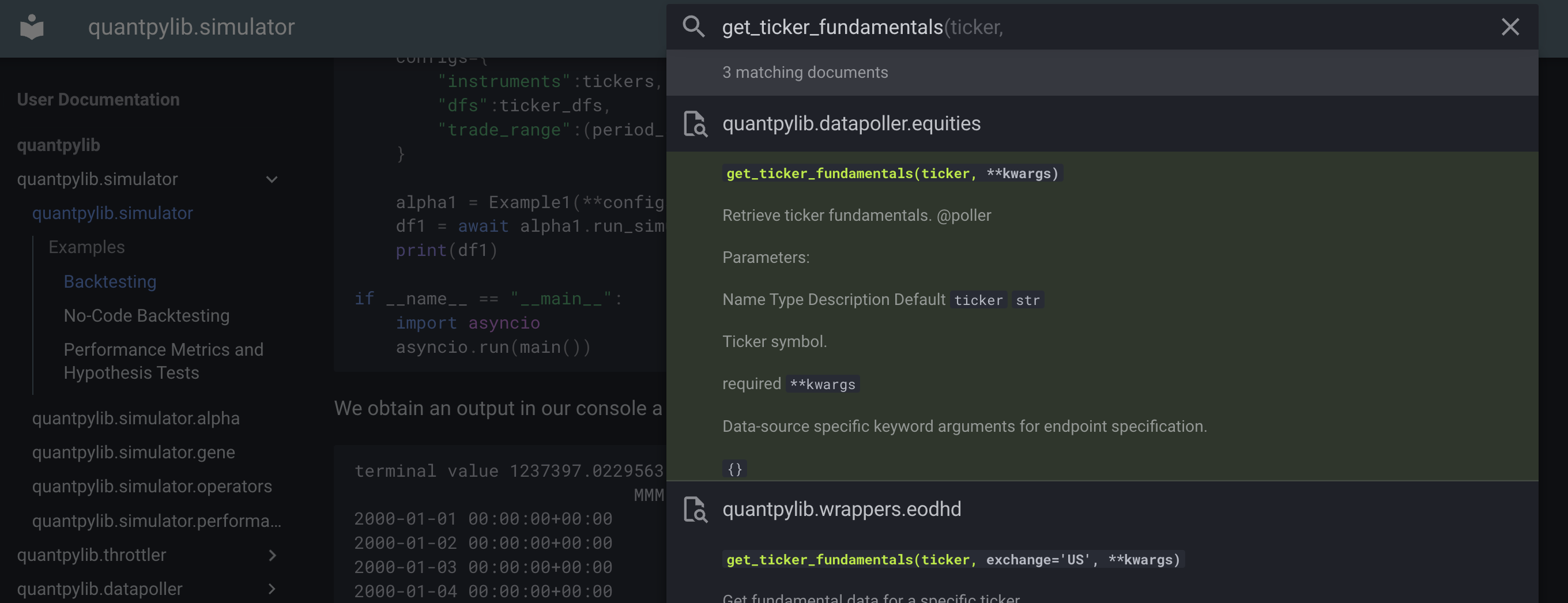

To understand the valid function signatures of each datapoller, we need to understand the function’s decorator-type,

which is indicated @poller or @ts_poller in the documentation, and is defined in quantpylib.datapoller.utils module for polling or time-series polling respectively.

The default arguments are supplied through these decorators, which also provide parameter-standardization and parameter-guessing

for vendor/source-unique specifications. Source-specific arguments are documented in its corresponding data-wrapper.

We now walkthrough how to construct a valid datapolling request and construct valid parameters to our datapollers for the various datasources. Note that the various endpoints and their matching

function name-signatures can be easily looked up in the search-bar (top right):

We need more data sources, more data pollers and more data endpoints to support. If there is a particular functionality you would like documented or implemented, please feel free to reach out to me @ hangukquant@gmail.com or submit a Github issue. Cheers.

Walkthrough

Supposed we are interested in getting some OHLC(V) data for equities.

From our quantpylib.wrappers library, we see that the datasources supported with equities data is eodhd and yfinance.

Suppose we have no API access to eodhd, so we will make a request through

the yfinance library. To see what endpoints are available

in the equities datapoller, we can just look at the documentation page - the sidebar has a summary,

which we see has a get_trade_bars method.

The arguments are not specified, but it is tagged

@ts_poller, which means the arguments to supply are

given by decorators, documented here.

The augmented arguments are ticker, start, end, periods

granularity, granularity_multiplier and src.

We shall provide ticker, start, periods and src to make our request, and let the rest settle to default arguments.

We already have the keys in our .env file in the current working directory, and we will make the following imports

import os

from dotenv import load_dotenv

load_dotenv()

from datetime import datetime

from quantpylib.datapoller.master import DataPoller

keys = {

"yfinance": True,

"eodhd": os.getenv("EOD_KEY"),

"binance": True,

"phemex": True,

"oanda": ("practice",os.getenv("OANDA_ACC"),os.getenv("OANDA_KEY")),

"coinbase": False,

}

get_trade_bars method and specify src="yfinance", like this:

datapoller = DataPoller(config_keys=keys)

df = datapoller.equities.get_trade_bars(

ticker="AAPL",

start=datetime(2000,1,1),

periods=365,

src="yfinance"

)

print(df)

open high low close volume

datetime

2000-01-03 00:00:00-05:00 0.792742 0.850379 0.768648 0.846127 535796800

2000-01-04 00:00:00-05:00 0.818254 0.836206 0.764869 0.774790 512377600

2000-01-05 00:00:00-05:00 0.784238 0.835733 0.778569 0.786128 778321600

2000-01-06 00:00:00-05:00 0.802191 0.808805 0.718098 0.718098 767972800

2000-01-07 00:00:00-05:00 0.729436 0.763452 0.721878 0.752113 460734400

... ... ... ... ... ...

2000-12-22 00:00:00-05:00 0.213539 0.226768 0.213539 0.226768 318052000

2000-12-26 00:00:00-05:00 0.224878 0.226768 0.215429 0.222044 216815200

2000-12-27 00:00:00-05:00 0.216846 0.223933 0.214484 0.223933 325466400

2000-12-28 00:00:00-05:00 0.217319 0.225823 0.216374 0.223933 305177600

2000-12-29 00:00:00-05:00 0.222044 0.226768 0.219209 0.224878 630336000

end=datetime(2000,1,1) instead

of start=datetime(2000,1,1), then

we will have data from 1999~2000. Or we can just specify

the start,end directly, which means we can exclude the

periods parameter, like this:

df = datapoller.equities.get_trade_bars(

ticker="AAPL",

start=datetime(2000,1,1),

end=datetime(2020,1,1),

src="yfinance"

)

print(df)

open high low close volume

datetime

2000-01-03 00:00:00-05:00 0.792742 0.850379 0.768648 0.846127 535796800

2000-01-04 00:00:00-05:00 0.818254 0.836206 0.764869 0.774790 512377600

2000-01-05 00:00:00-05:00 0.784238 0.835734 0.778569 0.786128 778321600

2000-01-06 00:00:00-05:00 0.802191 0.808805 0.718097 0.718097 767972800

2000-01-07 00:00:00-05:00 0.729436 0.763452 0.721878 0.752113 460734400

... ... ... ... ... ...

2019-12-24 00:00:00-05:00 69.250147 69.298799 68.819601 69.147980 48478800

2019-12-26 00:00:00-05:00 69.281768 70.536927 69.252580 70.519897 93121200

2019-12-27 00:00:00-05:00 70.814237 71.507495 70.084495 70.493149 146266000

2019-12-30 00:00:00-05:00 70.410455 71.196148 69.379088 70.911545 144114400

2019-12-31 00:00:00-05:00 70.524783 71.436962 70.425051 71.429665 100805600

quantpylib.wrappers.yfinance.YFinance.get_trade_bars method. You may use this as a standalone SDK,

but the parameters are alot more rigid. With the master datapoller, we can provide any 2 of the 3 of start, end, and periods.

But yfinance does not support too many endpoints, and is also

not stable, albeit free. Suppose we have an API key for

eodhd, we don't need to change much code:

df = datapoller.equities.get_trade_bars(

ticker="AAPL",

start=datetime(2000,1,1),

end=datetime(2020,1,1),

src="eodhd"

)

print(df)

open high low close adjusted_close volume

datetime

2000-01-03 104.8768 112.5040 101.6848 111.9328 0.8461 535796800

2000-01-04 108.2480 110.6224 101.1920 102.5024 0.7748 512377600

2000-01-05 103.7456 110.5664 102.9952 104.0032 0.7862 778321600

2000-01-06 106.1200 107.0048 94.9984 94.9984 0.7181 767972800

2000-01-07 96.4992 101.0016 95.5024 99.5008 0.7521 460734400

... ... ... ... ... ... ...

2024-03-28 171.7500 172.2300 170.5100 171.4800 171.4800 65672700

2024-04-01 171.1900 171.2500 169.4800 170.0300 170.0300 46240500

2024-04-02 169.0800 169.3400 168.2300 168.8400 168.8400 49329500

2024-04-03 168.7900 170.6800 168.5800 169.6500 169.6500 47602100

2024-04-04 170.2900 171.9200 168.8200 168.8200 168.8200 53289969

src="eodhd", the equities datapoller

has that as its default, and the @ts_poller decorator is capable of guessing some parameters. This of course routs the request to quantpylib.wrappers.eodhd.Eodhd.get_trade_bars. Different from the yfinance wrapper's get_trade_bars endpoint, there is an additional parameter

exchange="US", that is specific to the eodhd REST API.

They have parameters to identify which asset with the same

ticker the client is referring to, but this nomenclature is unique to this particular vendor. This parameter is actually also

guessed by the @ts_poller decorator, but if we know precisely

what we want, we should pass it in as arguments, as we may guess

wrongly - here is an example of AAPL on the US and Mexican exchanges:

df = datapoller.equities.get_trade_bars(

ticker="AAPL",

start=datetime(2000,1,1),

end=datetime(2020,1,1),

src="eodhd",

exchange="US"

)

print(df)

df = datapoller.equities.get_trade_bars(

ticker="AAPL",

start=datetime(2000,1,1),

end=datetime(2020,1,1),

src="eodhd",

exchange="MX"

)

print(df)

open high low close adjusted_close volume

datetime

2000-01-03 104.8768 112.5040 101.6848 111.9328 0.8461 535796800

2000-01-04 108.2480 110.6224 101.1920 102.5024 0.7748 512377600

2000-01-05 103.7456 110.5664 102.9952 104.0032 0.7862 778321600

2000-01-06 106.1200 107.0048 94.9984 94.9984 0.7181 767972800

2000-01-07 96.4992 101.0016 95.5024 99.5008 0.7521 460734400

... ... ... ... ... ... ...

2024-03-28 171.7500 172.2300 170.5100 171.4800 171.4800 65672700

2024-04-01 171.1900 171.2500 169.4800 170.0300 170.0300 46240500

2024-04-02 169.0800 169.3400 168.2300 168.8400 168.8400 49329500

2024-04-03 168.7900 170.6800 168.5800 169.6500 169.6500 47602100

2024-04-04 170.2900 171.9200 168.8200 168.8200 168.8200 53289969

[6102 rows x 6 columns]

open high low close adjusted_close volume

datetime

2004-12-20 704.4184 704.4184 694.5484 697.9980 11.0377 722401

2004-12-21 702.4780 704.4996 702.4780 703.8080 11.1296 1804322

2004-12-27 705.1688 705.1688 705.1688 705.1688 11.1511 140000

2005-01-05 738.7380 738.7380 738.7380 738.7380 11.6819 14560

2005-03-07 471.2496 471.2496 471.2496 471.2496 14.9041 266000

... ... ... ... ... ... ...

2024-03-27 2846.0000 2874.9900 2842.0000 2874.4299 2874.4299 1941

2024-04-01 2873.0000 2873.0000 2819.3500 2827.2100 2827.2100 16860

2024-04-02 2808.0000 2813.6900 2792.5000 2799.7800 2799.7800 23005

2024-04-03 2798.0000 2829.9900 2798.0000 2810.0000 2810.0000 7258

2024-04-04 2810.0000 2839.9900 2800.0000 2807.0300 2807.0300 3685

df = datapoller.equities.get_trade_bars(

ticker="BTC-USD",

start=datetime(2000,1,1),

end=datetime(2020,1,1),

src="eodhd"

)

crypto poller

df = datapoller.crypto.get_trade_bars(

ticker="BTC-USD",

start=datetime(2000,1,1),

end=datetime(2020,1,1),

src="eodhd"

)

print(df)

open high low close adjusted_close volume

datetime

2010-07-17 0.049510 0.049510 0.049510 0.049510 0.049510 0

2010-07-18 0.049510 0.049510 0.049510 0.049510 0.049510 0

2010-07-19 0.085840 0.085840 0.085840 0.085840 0.085840 0

2010-07-20 0.080800 0.080800 0.080800 0.080800 0.080800 0

2010-07-21 0.074740 0.074740 0.074740 0.074740 0.074740 0

... ... ... ... ... ... ...

2024-03-31 69647.779030 71377.779498 69624.868677 71333.647926 71333.647926 20050941373

2024-04-01 71333.484717 71342.091454 68110.696020 69702.146113 69702.146113 34873527352

2024-04-02 69705.024322 69708.381258 64586.594304 65446.974233 65446.974233 50705240709

2024-04-03 65446.671764 66914.322564 64559.899948 65980.808650 65980.808650 34488018367

2024-04-04 65975.696667 69291.254806 65113.796534 68508.841844 68508.841844 34439527442

@ts_poller adds a layer of complexity, but it's purpose is to both be extremely flexible in the arguments the methods takes in, to generalize to arbitrary data-sources,

while still providing the simplest possible unified-interface

at the user-level by routing to the correct wrapper's endpoint.

In fact, if we knew how they were routed, some 'wrong' calls

actually work:

df = datapoller.equities.get_trade_bars(

ticker="BTC-USD",

start=datetime(2000,1,1),

end=datetime(2020,1,1),

src="eodhd",

exchange="CC"

)

equities datapoller, we specified the CC exchange which maps to the

crypto asset class in the eodhd vendor. Of course, we do not

recommend such workarounds. Note that additional arguments to otherwise valid requests are simply ignored - this request is valid:

df = datapoller.crypto.get_trade_bars(

ticker="BTC-USD",

start=datetime(2000,1,1),

end=datetime(2020,1,1),

src="eodhd",

gibberish="gibberish"

)

@poller method, such as

the quantpylib.datapoller.equities.get_ticker_fundamentals. The @poller only asks for the src parameter,

while get_ticker_fundamentals asks for a ticker parameter, so we can do

that routs to the eodhd wrapper.

Everything else is the same.

Safe-Throttling

As far as possible, when the specified endpoint specifies rate-limits, rapid submission of requests are sent-through

to the data-vendor as quickly as possible, while respecting the

rate-limits. This is done by using our custom semaphore-like logic,

defined in the quantpylib.throttler.rate_semaphore.

This is specific to each data-vendor, and each instance of the wrapper around

our data-source has its own resource-pool. This design is to maximise throughput of user-requests, and is supported in both asynchronous and synchronous methods. All requests submitted to a specific datasource with

throttle-support will be paced, with support for multi-threading or coroutines. For instance, suppose we do

import threading

import requests

try:

def raw():

response=requests.get(f"https://eodhd.com/api/fundamentals/AAPL.US?api_token={os.getenv('EOD_KEY')}&fmt=json")

if response.status_code == 429: raise Exception("TooManyTooFast")

else: print(response.status_code)

req=lambda:datapoller.equities.get_ticker_fundamentals(ticker="AAPL")

threads=[threading.Thread(target=raw,args=()) for i in range(500)]

# req=lambda:datapoller.equities.get_ticker_fundamentals(ticker="AAPL")

# threads=[threading.Thread(target=req,args=()) for i in range(500)]

for thread in threads: thread.start()

for thread in threads: thread.join()

except Exception as err:

print(err)

429 TooManyRequests code, while if we try:

# req=lambda:datapoller.equities.get_ticker_fundamentals(ticker="AAPL")

# threads=[threading.Thread(target=raw,args=()) for i in range(500)]

req=lambda:datapoller.equities.get_ticker_fundamentals(ticker="AAPL")

threads=[threading.Thread(target=req,args=()) for i in range(500)]

Examples

A number of examples are given. This would be the setup:

import os

import asyncio

from dotenv import load_dotenv

load_dotenv()

from datetime import datetime

from quantpylib.datapoller.master import DataPoller

keys = {

"yfinance": True,

"eodhd": os.getenv("EOD_KEY"),

"binance": True,

"phemex": True,

"oanda": ("practice",os.getenv("OANDA_ACC"),os.getenv("OANDA_KEY")),

"coinbase": False,

}

datapoller = DataPoller(config_keys=keys)

async def main():

pass #code here

if __name__ == "__main__":

asyncio.run(main())

Get OHLCV

Let's get OHLCV for crypto, currencies and equities.

We get AAPL, EUR_USD, BTCUSDT OHLCV data from

the equities, currencies and crypto datapoller

using source eodhd, oanda and binance respectively.

start,end=datetime(2020,1,1),datetime.now()

df1=datapoller.equities.get_trade_bars(ticker="AAPL",start=start,end=end,granularity="d",src="eodhd")

df2=datapoller.currencies.get_trade_bars(ticker="EUR_USD",start=start,end=end,granularity="d",src="oanda")

df3=datapoller.crypto.get_trade_bars(ticker="BTCUSDT",start=start,end=end,granularity="d",src="binance")

print(df1,df2,df3)

df=datapoller.currencies.get_trade_bars(ticker="EUR_USD",granularity="h",granularity_multiplier=4,start=start,end=end,src="oanda")

print(df)

open high low close volume

datetime

2020-01-01 22:00:00+00:00 1.12124 1.12246 1.12124 1.12209 673

2020-01-02 02:00:00+00:00 1.12206 1.12247 1.12010 1.12044 700

2020-01-02 06:00:00+00:00 1.12044 1.12140 1.12013 1.12032 2392

2020-01-02 10:00:00+00:00 1.12034 1.12039 1.11830 1.11966 2610

2020-01-02 14:00:00+00:00 1.11962 1.12030 1.11636 1.11700 4887

... ... ... ... ... ...

2024-04-04 17:00:00+00:00 1.08587 1.08620 1.08319 1.08374 13217

2024-04-04 21:00:00+00:00 1.08401 1.08441 1.08350 1.08416 9891

2024-04-05 01:00:00+00:00 1.08416 1.08431 1.08234 1.08264 7608

2024-04-05 05:00:00+00:00 1.08263 1.08464 1.08226 1.08376 9345

2024-04-05 09:00:00+00:00 1.08374 `1.08422 1.08350 1.08393 1436

oanda wrapper, and because Oanda places a limit of candles per request, given your polling-period and granularity desired, there may be multiple requests to

the Oanda REST API server to stitch together the non-overlapping periods. This is the advantage of our datapoller and wrapper interface - the user does not have to concern themselves with the source-specific limitations.

Get Tick Historical

Some endpoints support historical data. eodhd has support for

tick data on the US-listed common-stocks.

ticks=datapoller.equities.get_trade_ticks(ticker="META",start=datetime(2023,4,3,0,0,0), end=datetime(2023,4,3,12,0,0))

print(ticks)

ex mkt price seq shares sl sub_mkt ts

0 Q K 211.00 77001 5 @ TI 1680508800013

1 Q K 211.42 77002 1 @ TI 1680508800013

2 Q K 210.99 77124 10 @ TI 1680508800017

3 Q K 211.42 77125 7 @ TI 1680508800017

4 Q K 211.42 77127 30 @ TI 1680508800017

... .. .. ... ... ... ... ... ...

2071 Q Q 210.00 3635409 59 @FTI 1680523180411

2072 Q Q 210.00 3635410 41 @FTI 1680523180411

2073 Q K 210.00 3636017 800 @FT 1680523181713

2074 Q Q 210.00 3636650 20 @FTI 1680523184200

2075 Q K 210.00 3637810 27 @FTI 1680523185877

[2076 rows x 8 columns]

Get Fundamentals

Some assets and datasources support fundamental data. We could get fundamental data for Goldman Sachs and Ethereum like this:

f1=datapoller.equities.get_ticker_fundamentals(ticker="GS",src="eodhd")

f2=datapoller.crypto.get_ticker_fundamentals(ticker="ETH-USD",src="eodhd")

Get Exchange Universe

We might also be interested in getting the listed set of tickers for

a data vendor or exchange. In the case of eodhd, a data vendor,

they support multiple exchanges. We can type in the search-bar (top right)

for the endpoint get_tickers_in_exchange, and we see binance, eodhd

and oanda support this endpoint through the exchange datapoller.

We can see that the eodhd endpoint takes in an exchange parameter,

so we can ask for their US-listed stocks as follows:

oanda)

tickers = datapoller.exchange.get_tickers_in_exchange(src="binance")

tickers = datapoller.exchange.get_tickers_in_exchange(src="oanda")

get_trade_bars and common methods. This is a point for improvement that we are hoping contributors can come in,

as we need the manpower!

Streaming Data

We are capable of streaming market data in an extremely simple interface.

This is interfaced by an asynchronous method in the datapoller in question,

and all streamed data is stored in the objects' stream_buffer attribute,

which is a collections.defaultdict object with deque as the buffer

for each streamed datapoint.

We can see that both eodhd and currencies support it, so we can make request:

await datapoller.currencies.stream_market_data(ticker="EURUSD",src="eodhd")

while True:

print(datapoller.currencies.stream_buffer["EURUSD"])

await asyncio.sleep(3)

stream_buffer anytime we want, which maintains the current

stream state. The length of stream_buffer is controlled by the object instantiation for any

datapoller instance, see quantpylib.datapoller.base.BasePoller. The first two iterations

give:

deque([], maxlen=1000000000)

deque([{'s': 'EURUSD', 'a': 1.0835, 'b': 1.0834, 'dc': '-0.0379', 'dd': '-0.0004', 'ppms': False, 't': 1712331637066}, {'s': 'EURUSD', 'a': 1.0835, 'b': 1.0834, 'dc': '-0.0378', 'dd': '-0.0004', 'ppms': False, 't': 1712331637140}, {'s': 'EURUSD', 'a': 1.0835, 'b': 1.0834, 'dc': '-0.0377', 'dd': '-0.0004', 'ppms': False, 't': 1712331637278},

{'s': 'EURUSD', 'a': 1.0835, 'b': 1.0834, 'dc': '-0.0393', 'dd': '-0.0004', 'ppms': False, 't': 1712331637844}, {'s': 'EURUSD', 'a': 1.0835, 'b': 1.0834, 'dc': '-0.0383', 'dd': '-0.0004', 'ppms': False, 't': 1712331637948}, {'s': 'EURUSD', 'a': 1.0835, 'b': 1.0834, 'dc': '-0.0374', 'dd': '-0.0004', 'ppms': False, 't': 1712331638154},

{'s': 'EURUSD', 'a': 1.0836, 'b': 1.0835, 'dc': '-0.0306', 'dd': '-0.0003', 'ppms': False, 't': 1712331638426}, {'s': 'EURUSD', 'a': 1.0835, 'b': 1.0835, 'dc': '-0.028', 'dd': '-0.0003', 'ppms': False, 't': 1712331638445}, {'s': 'EURUSD', 'a': 1.0835, 'b': 1.0835, 'dc': '-0.028', 'dd': '-0.0003', 'ppms': False, 't': 1712331638725}, {'s': 'EURUSD', 'a': 1.0835, 'b': 1.0835, 'dc': '-0.032', 'dd': '-0.0003', 'ppms': False, 't': 1712331638748}, {'s': 'EURUSD', 'a': 1.0835, 'b': 1.0835, 'dc': '-0.0283', 'dd': '-0.0003', 'ppms': False, 't': 1712331639048}], maxlen=1000000000)

await datapoller.currencies.stream_market_data(ticker="EURUSD",src="eodhd")

await datapoller.currencies.stream_market_data(ticker="EUR_USD",src="oanda")

await datapoller.equities.stream_market_data(ticker="AAPL",src="eodhd")

await datapoller.crypto.stream_market_data(ticker="BTC-USD",src="eodhd")

while True:

print(datapoller.currencies.stream_buffer["EURUSD"])

print(datapoller.currencies.stream_buffer["EUR_USD"])

print(datapoller.equities.stream_buffer["AAPL"])

print(datapoller.crypto.stream_buffer["BTC-USD"])

await asyncio.sleep(3)

await lines above are executed one-after-another,

to call concurrently, we can use gather, which we demonstrate in using for closing the streams:

await asyncio.gather(

*[

datapoller.currencies.close_market_data_stream(ticker="EURUSD",src="eodhd"),

datapoller.currencies.close_market_data_stream(ticker="EUR_USD",src="oanda"),

datapoller.equities.close_market_data_stream(ticker="AAPL",src="eodhd"),

datapoller.crypto.close_market_data_stream(ticker="BTC-USD",src="eodhd")

]

)

Queries

Some data vendors provide a functionality to input some string or alternatively

formatted specification into their search engine.

This is provided in the quantpylib.datapoller.metadata.query_engine

method:

Code Exchange Name Type ... Currency ISIN previousClose previousCloseDate

0 AAPL US Apple Inc Common Stock ... USD US0378331005 168.8200 2024-04-04

1 AAPL BA Apple Inc DRC Common Stock ... ARS US0378331005 8925.5000 2024-04-04

2 AAPL MX Apple Inc Common Stock ... MXN US0378331005 2807.0300 2024-04-04

3 AAPL NEO Apple Inc CDR Common Stock ... CAD CA03785Y1007 25.0400 2024-04-04

4 AAPL SN Apple Inc Common Stock ... USD US0378331005 170.5200 2024-04-04

5 AAPL34 SA Apple Inc Common Stock ... BRL BRAAPLBDR004 42.8200 2024-04-04

6 AAPU US Direxion Shares ETF Trust - Direxion Daily AAP... ETF ... USD US25461A8743 21.9100 2024-04-04

7 AAPD US Direxion Shares ETF Trust - Direxion Daily AAP... ETF ... USD US25461A3041 23.0400 2024-04-04

8 APLY US YieldMax AAPL Option Income Strategy ETF ETF ... USD US88634T8577 16.5600 2024-04-04

9 3SAP PA Granite -3x AAPL ETF ... EUR XS2193970030 26.9500 2024-04-04

10 APLY NEO APPLE (AAPL) Yield Shares Purpose ETF ETF ... CAD None 22.7000 2024-04-04

11 3LAP PA Granite +3x AAPL ETF ... EUR XS2193969883 18.4260 2024-04-04

12 SALE LSE Leverage Shares 3x Short Apple (AAPL) ETP Secu... ETF ... EUR XS2472334742 2.9949 2024-04-04

13 3SAA XETRA Leverage Shares -3x Short Apple AAPL ETF ... EUR XS2472334742 2.9892 2024-04-04

14 AAPY US Kurv Yield Premium Strategy Apple (AAPL) ETF ETF ... USD None 23.3839 2024-04-04